Use this free manufacturing business plan to start and grow a thriving, profitable manufacturing business. Includes market analysis, strategy, more. Works for any type of manufacturing company. Free download available to customize the plan in Word or PDF for your business Sep 10, · HONG KONG: Struggling property giant China Evergrande Group repaid matured wealth management products of less than , yuan (US$15,) on Sept. 9 as part of an interim repayment plan for Management buyout (MBO) In a management buyout, the business’s current management team buys out the current owner. Business owners often prefer MBOs if they are retiring or if a majority shareholder wants to leave the company. They’re also useful for large enterprises that want to sell divisions that are underperforming or that aren’t

China Evergrande outlines interim repayment plan for retail investors - REDD - CNA

Try these: time management relationship advice healthy lifestyle money wealth success leadership psychology. Home » Business Cycle » Leveraged buyouts. Have you been thinking about your business exit strategy? If you are ready to sell and move to pursue your next passion, you may want to consider a leveraged buyout.

What is an LBO in straightforward terms? A leveraged buyout is when one company acquires another using a significant amount of financing, meaning the buyout is funded with debt. The company doing the acquiring in a leveraged buyouttypically a private equity firm, will use its assets as leverage. The assets and cash flows of the company that is being acquired called the target company or seller are also used as collateral and to pay for the financing cost.

The purpose of an LBO is to allow a company to make a major acquisition without committing a business plan management buyout of capital. While a leveraged buyout can be complicated and take a while to complete, it can benefit both the buyer and seller when done correctly.

In short, Business plan management buyout allow firms better equity returns. Why would a target company want to sell via LBO? The seller is able to get the price they business plan management buyout for the business and has a way to exit the company with a solid plan in place, business plan management buyout.

A leveraged buyout is an ideal exit strategy for business owners looking to cash out at the end of their careers. If you run a publicly traded company, you can use a leveraged buyout to consolidate the public shares and transfer them to a private investor who takes the shares off the market.

The investors will business plan management buyout own a majority of or all of your company and will assume the debt liability of the transaction. For business plan management buyout, an LBO is useful if the business needs to be repackaged and returned to the marketplace after adjustments are made to make it more marketable. Many business owners have used efficiency strategies to make their companies profitable and attractive to potential buyers.

However, some companies grow so large and inefficient that it becomes more profitable for a buyer to use a leveraged buyout to break it up and sell it as a series of smaller companies. These individual sales are typically more than enough to pay off the loan of purchasing the company as a whole. If you have a company with different target markets for various products, this might be a good option.

An LBO of this type can then give the smaller companies a better chance to grow and stand out than they would have had as part of an inefficient conglomerate.

If an investor believes your company could eventually be worth much more than it is currently, a leveraged buyout could be a good option. The investor would assume the debt with the belief that holding onto the company for a certain amount of time will increase its value and allow them to pay off the debt and make a profit.

In this type of leveraged buyoutyou as the business owner would want to exit the company before it becomes profitable, but not sacrifice the profit that is likely to come in the future.

Taking the LBO money from the purchaser helps you realize part of that profit now so you can turn your sights to other ventures. Another common leveraged buyout occurs when a smaller company wants to be acquired by a larger competitor. This allows the smaller company to grow dramatically and can help them gain new customers and scale more quickly than they would business plan management buyout able to without the acquisition. This can be a good way to bring other investors and knowledgeable leaders on board and take advantage of peer elevation.

With a more robust and varied team in place, you can take a previously underperforming company to new levels if you want to stay on with the business plan management buyout. Many business owners sell their company via a leveraged buyout but stay on as a consultant to retain connections and help the business continue to grow. Other business owners use an LBO as a way to exit the company completely to pursue one where they have more passion as well as profitability.

Business owners often prefer MBOs if they are retiring or if a majority shareholder wants to leave the company. The buyers enjoy a greater financial incentive when the business succeeds than they would have if they remained employees. Management buyouts have many advantages, in particular the continuity of operations, business plan management buyout. When the management team does not change, the owner can expect a smoother transition with business continuing to business plan management buyout profitably.

On paper, a management buy-in works similarly to a management buyout — but there are notable differences. In this scenario, the business is bought out by external investors, who then replace the management team, board of directors and other personnel with their own representatives.

MBIs typically occur when a company is undervalued or underperforming, business plan management buyout. Management buy-ins do not come with the stability that management buyouts are known for.

In fact, MBIs often create instability as entire teams are replaced. However, business plan management buyout, MBIs do provide an exit strategy for owners who want to retire or who are in over their heads — and for the buyer, business plan management buyout, they can be a good investment opportunity when handled correctly. A secondary buyout — as the name business plan management buyout — is a buyout of a buyout. Instead of selling it back to the public as in a traditional LPO, they then sell that business to a different firm, business plan management buyout.

This allows the seller to end all involvement with the business, giving them immediate liquidity and a clean break. The advantage to the buyer in secondary buyouts is that they can then improve on the business and sell it back to the public at a higher price.

They are also useful for businesses that operate in a very specific niche, are small or that have high cash flows but slow growth. LBOs have clear advantages for the buyer: they get to spend less of their own money, get a higher return on investment and help turn companies around.

What is an LBO for the seller, and why would they business plan management buyout one? One of the main advantages of a leveraged buyout is the ability to sell a business that might not be at its peak performance but still has cash flow and the potential for growth. If the buyer is the current management, business plan management buyout, employees can also benefit from executives that are now more engaged in the business, because they own a larger stake.

Business plan management buyout leveraged buyout also allows groups such as employees or family members to acquire a company, if, for example, the current owner is retiring, which can also lead to greater engagement. Business plan management buyout, if the target company is privately held, the seller could realize tax advantages from the LBO.

In a n LBO, the same leverage that allows greater reward also comes with greater risk. Depending on how the buyer defines risk and how risk-tolerant he or she is, business plan management buyout, this could be attractive or it could be a source of anxiety. The risks of a leveraged buyout for the target company are also high. Interest rates on the debt they are taking on are often high, and can result in a lower credit rating. LBOs are especially risky for companies in highly competitive or volatile markets.

Aside from risk, there are several criticisms of leveraged buyouts that are worth considering. Because the company will often focus on cutting costs post-buyout in order to pay back the debt more quickly, LBOs sometimes result in downsizing and layoffs.

They can also mean that the company does not make investments in things like equipment and real estate, leading to decreased competitiveness in the long term.

Another criticism of LBOs is that they can be used in a predatory manner. One way that this happens is when management of a company organizes an LBO to sell it back to themselves and gain short-term personal profit, business plan management buyout.

Predatory buyers can also business plan management buyout vulnerable companies, take them private using an LBO, break them up and sell off assets — then declare bankruptcy and earn a high return.

This is the tactic private equity firms used in the s and s that led to leveraged buyouts garnering a negative reputation. To truly understand leveraged buyoutsyou can take a look at examples of both beneficial and failed LBOs. They purchased Chewy. The buyout was funded mostly with debt and the agreement that Safeway would divest some assets and close underperforming stores. Hilton Hotels Leveraged buyouts can be successful in economic downturns. The economy plummeted and travel was especially hard-hit.

Blackstone initially lost money, but it survived thanks to its focus on management and debt restructuring. However, they did eventually bounce back, enjoying profitability for several decades before falling sales recently led to more troubles — this time not related to leveraged buyouts.

There are five typical phases in the life cycle of a business. Knowing which phase your company is in can help you decide whether a leveraged buyout is the right option or if you need to postpone selling. This is the stage where you hone your offerings and attempt to make your business talkably different. Some business owners are able to extend this stage of the cycle by using constant strategic innovation or entering new markets. LBOs provide a means of exit that is realistic for many companies.

Thinking about selling your company through a leveraged buyout? This means you have things like tangible assets, good working capital and positive cash flows. Having a positive balance sheet means lenders are more likely to lend to you.

Firms looking to acquire companies through a leveraged buyout typically also look for proven management and a diverse, loyal customer base. Companies that may be struggling due business plan management buyout a recession in their industry or poor management but still have positive cash flow are also good LBO candidates.

Investors may see an opportunity to create efficiencies and improve the business and therefore be interested in acquiring it, business plan management buyout. Making the decision to consider a leveraged buyout of your company is not something to be taken lightly. How will you feel once you sell? A business coach can look at the prospect objectively and without the emotion that you as the business owner will bring to the decision.

With their help, you can make a solid decision that is best for your future. Despite some bad press in recent years, a leveraged buyout is a viable exit strategy in many situations. As with any business decision, business plan management buyout, weigh the pros and cons before making your decision.

What can we help you find? Generic filters Hidden label. Hidden label. Ultimate guide to leveraged buyouts Have you been thinking about your business exit strategy? Reveal the best next steps for your business Take a 5-minute assessment. What is a leveraged buyout? Why do businesses use LBOs? Here are some additional reasons why a business owner would consider a leveraged buyout:. To make a public company private If you run a publicly traded company, business plan management buyout, you can use a leveraged buyout to consolidate the public shares and transfer them to a private investor who takes the shares off the market.

To break up a large company.

What is Buyout? - MBO, LBO , LMBO Explaied-- by: Lalit Choudhary

, time: 6:38Foot Locker (FL) Closes WSS Buyout, Expansion Plan on Track

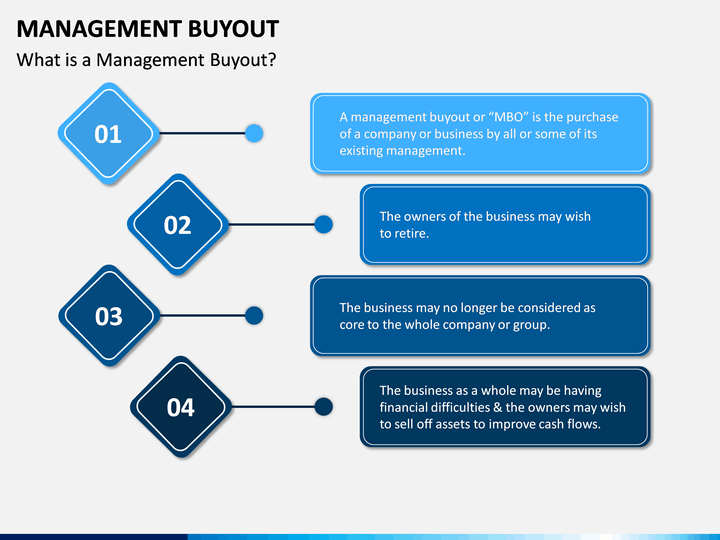

A management buyout (MBO) is a corporate finance transaction where the management team of an operating company acquires the business by borrowing money to buy out the current owner(s). An MBO transaction is a type of leveraged buyout (LBO) and can sometimes be referred to as a leveraged management buyout (LMBO) Sep 10, · HONG KONG: Struggling property giant China Evergrande Group repaid matured wealth management products of less than , yuan (US$15,) on Sept. 9 as part of an interim repayment plan for A management buyout (MBO) is a transaction where a company’s management team purchases the assets and operations of the business they manage. A management buyout is

No comments:

Post a Comment